Renters Insurance in and around Baltimore

Baltimore renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - size, outdoor living space, internet access, townhome or condo - getting the right insurance can be essential in the event of the unpredictable.

Baltimore renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Why Renters In Baltimore Choose State Farm

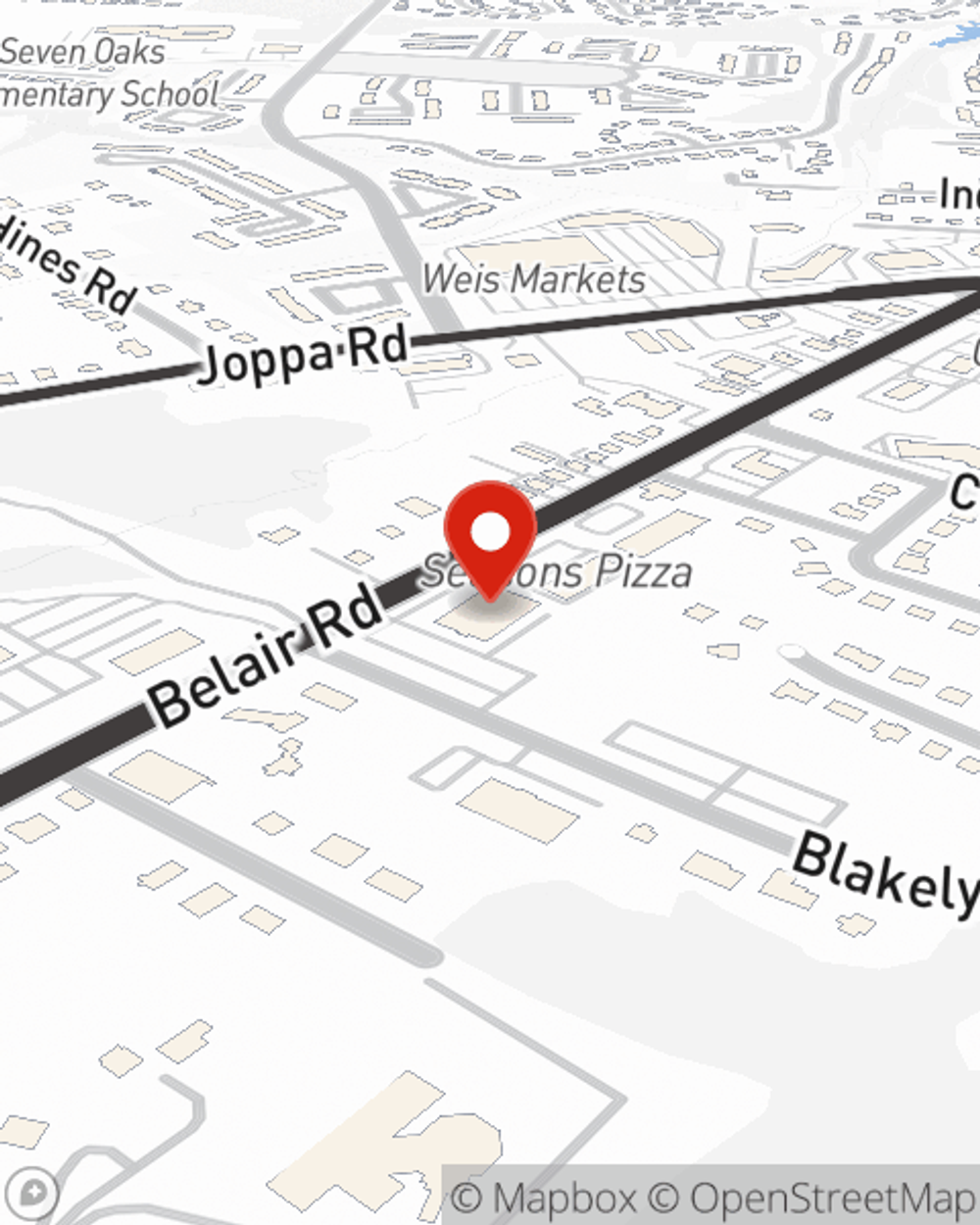

When the unexpected break-in happens to your rented property or space, generally it affects your personal belongings, such as a bicycle, sports equipment or a TV. That's where your renters insurance comes in. State Farm agent Natasha Parker has the knowledge needed to help you evaluate your risks so that you can keep your things safe.

Get in touch with State Farm Agent Natasha Parker today to experience how the trusted name for renters insurance can protect items in your home here in Baltimore, MD.

Have More Questions About Renters Insurance?

Call Natasha at (410) 238-0071 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Natasha Parker

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.