Business Insurance in and around Baltimore

Calling all small business owners of Baltimore!

Helping insure businesses can be the neighborly thing to do

Insure The Business You've Built.

When you're a business owner, there's so much to remember. You're not alone. State Farm agent Natasha Parker is a business owner, too. Let Natasha Parker help you make sure that your business is properly covered. You won't regret it!

Calling all small business owners of Baltimore!

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your take-home pay, but also helps with regular payroll expenses. You can also include liability, which is crucial coverage protecting you in the event of a claim or judgment against you by a visitor.

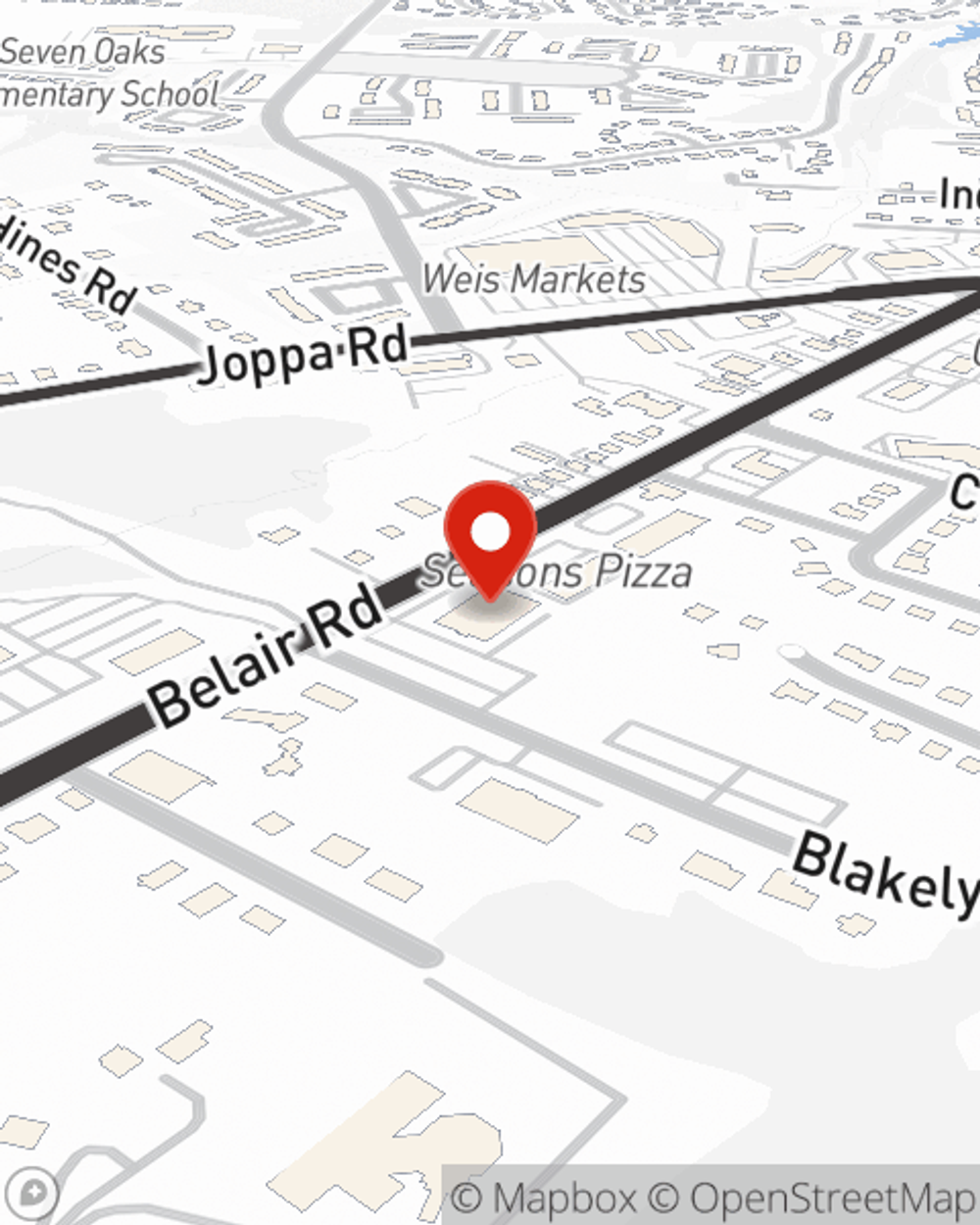

Contact State Farm agent Natasha Parker today to explore how a State Farm small business policy can ease your worries about the future here in Baltimore, MD.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Natasha Parker

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.